A risk-reward analysis is a very simple tool which can help you assess the risk and reward profile of completely different options. It works in the same way as a risk-return analysis which you may already be familiar with.

It can be applied at any level, for example:

- by a CEO for comparing different strategic directions for the company.

- by a program manager deciding which projects to keep within the program and which to discard.

- by a project manager deciding how to sequence tasks

- or simply by an individual team member deciding how best to spend their day.

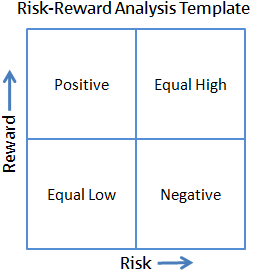

The template works by having risk plotted along one axis and reward along the other. In the diagram below I’ve divided the template into four sections to show you how to interpret the information.

The four categories from the diagram above are as follows:

- Equal Low: where risk and reward are both proportional and low.

- Equal High: where risk and reward are both proportional and high.

- Positive: represents a positive risk-reward balance, where a higher return can be achieved with limited risk.

- Negative: represents a negative risk-reward balance, where a low return is the reward for taking on a relatively high risk.

How to Use it

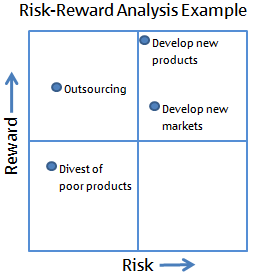

First, you need to create a list of all the different options and their possible rewards. This can done quickly and roughly, or can involve serious effort (market research, scenario development etc) – the effort you put in will depend on the size of the decision you are making. Examples of some options might include: outsourcing non-core activities, stop investing in poorly performing product lines, invest in new products, or investing to move into new markets. Once you have all the options and their potential reward, they should be plotted on the risk-reward chart:

At this stage some options will appear to have a more favourable risk-reward profile than others, such as outsourcing in the above example, but it is work taking the time to investigate whether any options can have their risks mitigated, or if there are options that can have their rewards boosted, before making a final decision on which option to go with. In the above example, if the risk of developing new products could be mitigated somehow then that option would become more favourable than outsourcing.

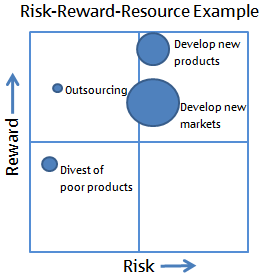

Finally, for an even more complete picture to further aid our decision making, we can add resources to the risk-reward template. In the diagram below, the bigger the bubble the more resources are required to execute that option.

With risk, reward, and resources all plotted, we are able to trade them against one another to find the best option for us. From the diagram above you can see that outsourcing is probably the most favourable option, providing plenty of upside reward but requiring minimal resource and having little risk. Additionally, with so few resources engaged in making the outsourcing happen, perhaps some investigative work can start on the new product development option with some of the spare resource.